In the September’s Denver Silver Forum in the 2015, a board from gold-skillfully developed concerned a consensus you to gold has been overvalued and may likely slide below $step 1,000, possibly to around $800. Additionally, in the LBMA/LPPM gold meeting in the Vienna, a specialist committee conversation on the gold developed almost a keen identical consensus. The fresh committee in addition to requested you to definitely silver tend to shed to help you less than $1,one hundred thousand, and perhaps in order to $800 or reduced. Thus, unfortunately, the important points do not contain the commonly accepted proposal and this seems to help you once again getting on offer. Indeed, usually, it is more prevalent to see places to purchase the gold at the the fresh levels of the market, whereas central financial selling often marks the end of a keep market within the gold.

Muhurat Exchange 2025 Live: Stocks to look at inside the Muhurat trading training today

Gold stays inside a strong uptrend, backed by good principles and you will a robust tech breakout. Even after small-label pullbacks and you can blended international signals, the newest steel will continue to focus investors since the a safe refuge. Key support accounts up to $3,200 and you will $step 3,one hundred thousand will be extremely important from the upcoming days. The newest optimistic energy will continue provided silver retains more than these types of accounts. Gold’s current increase is actually owing to a mixture of monetary and you can geopolitical items.

Chart 3: Wholesale request weak significantly inside the Q1 even with an excellent rebound within the March

The modern environment remembers past silver spikes in the 1970s and you can very early 2000s, whenever economic suspicion and you may rising cost of living eroded trust inside the conventional assets. But really, rather than previous schedules, today’s rally is actually supported by a far more interrelated worldwide savings and a fusion of commercial and you will aesthetic demand. But main financial to shop for, macro suspicion, and around the world ETF streams played good catalysts. Gold, at the same time, provided the fresh kick in the new collection, due to its dual identity while the each other a commercial and you may a great rare metal. In the meantime, buyers continues to seriously consider the real difference inside futures and you will put Silver prices.

Silver features increased over $cuatro,one hundred thousand but still reveals possibility then development. However, a quick pullback might result while the rates peaks from the short-term. Which refuse can be short-term and may expose a to buy window of opportunity for next rally. People can get believe including positions inside the silver through the such modifications. Meanwhile, Bitcoin try combining inside a variety above the key $100,one hundred thousand level, get yourself ready for the alternative higher. The newest Fed is generally slowing down their firming, but it’s nevertheless definitely affecting the market industry.

The place rates graph truthfully accounts silver spot rates inside the actual-go out. Utilize the desk on the right to obtain the gold casino Cherry Gold review rate today within the oz, grams, and kilograms. Identify trend from the exploring our historic place price chart less than, demonstrating the cost of gold in different day frames, along with 24-times, 3 days, 7 days, thirty days, 3 months, YTD, 1 year, five years, and you may and all time. Store these pages to get precise or over-to-date gold put prices advice. So it experience introduced an international push to have diversification, which have silver emerging as the a preferred asset simply because of its freedom of political and you may economic sanctions. Along with decreasing the threat of seizure, main banking institutions take a look at silver since the a hedge up against rising cost of living and you may a solution to remove reliance upon dollars-heavy supplies.

SlotHunter

For years and years, these types of metals was signs away from wide range, strength, and you may art — as well as debt collectors … In recent years, main financial institutions across the China, the center East, and you will Europe have raised its gold reserves within larger diversification procedures. Organization investors have also lengthened ranking inside individually recognized dear-material holdings, strengthening an architectural floors underneath the industry. The modern golden point in time is not just a cyclical experience but shows a much deeper, architectural shift within the around the world financing, where conventional fiat currencies and you may sovereign personal debt are seen having increasing doubt. Since the central banking companies continue to diversify their supplies and you will investors seek concrete locations useful, gold’s shine is determined to help you be noticeable even better on the days and you may years into the future.

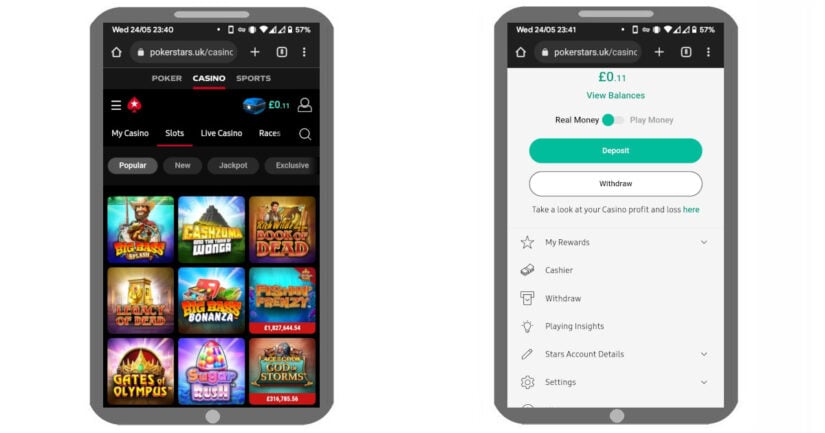

A deep failing to hold those individuals account get lead to a much deeper correction, however, bulls keep control for as long as the price stays above the newest triangle breakout. For those who’ve become stockpiling gold already, now’s a time and energy to money rates mediocre silver to decrease your costs reason behind better productivity. It is an excellent coal cart having golden rims, a collection of wonderful bills, an adhere from dynamite, a gold revolver, a case out of silver taverns, specific fantastic horseshoes, a great lantern, an excellent prospector’s come across and you can a good GR image to the a reddish record. Silver Rally has a gold exploration theme, the theory are you your self would be to generate leads to own silver if you are spinning the fresh reels.

- Silver prices have climbed 13.6% within the 2025 and you can broken $3,one hundred thousand per oz a week ago, function an alternative all-go out high.

- He been while the a swing investor, as he familiar with work with another community unrelated to your economic places.

- Countries is getting off the us buck in favor of gold,” reflecting so it change.

- Major banking companies, economic experts, and you will gold and silver benefits were currently optimistic for the gold starting 2024, however, so it surge has already shattered standards simply a quarter to your the entire year.

- The foundational suggestions will be totally invested based on the proper allocations.

For the past while, there’s started a good concerted energy because of the dozens of places so you can decouple in the Us dollar from process of de-dollarization. For those countries, silver might have been the brand new investment of choice to change the new USD. Their essential role in the renewable energy, technology, and you will electrification brings an additional foundation of consult. Because the nations build green infrastructure, silver’s programs within the solar cells and state-of-the-art electronics are expected to help you speed, strengthening the a lot of time-name lack. Silver’s up impetus are intensified by the persistent have deficits.

- The brand new Fed price slices, and chronic rising cost of living, might force genuine rates lower and deteriorate the newest U.S. buck subsequent.

- Once more, issues regarding your efforts out of rising prices and you can a possible stagflationary ecosystem have seen silver become popular.

- Gold’s upward momentum is going to continue the coming year with 2025 costs averaging $2,700.

- The organization asset possession landscaping has constantly changed during the last 5 years, that have Bitcoin (BTC) growing since the a hold asset one another to the organization harmony sheets and in the authorities treasuries.

Concurrently, the new Fed inserted exchangeability to the system from the settling reverse repo money and you will reducing the Treasury Standard Membership (TGA), which pushed more income to the economic places. Certainly, Gold Rally stands out as among the better three-reel position games available, offering an appealing gameplay knowledge of the potential in order to victory lifetime-changing sums. For those who search the ability to strike they rich, Silver Rally is actually a worthy choice, even when a sense of the truth is necessary to prevent spending forecast winnings too quickly.

Investing gold mining organizations is a sure way to help you ride the new rally as opposed to myself buying the metal. Finest picks for example significant gold exploration organizations provides stuck the eye away from wide range executives due to their income growth and you may strategic industry placement. These companies work for straight from ascending silver cost, as his or her margins build with every uptick from the steel’s really worth. The fresh Government Put aside continues to be the single strongest impact on beloved-metals rates.